Word格式/直接打印/内容可修改

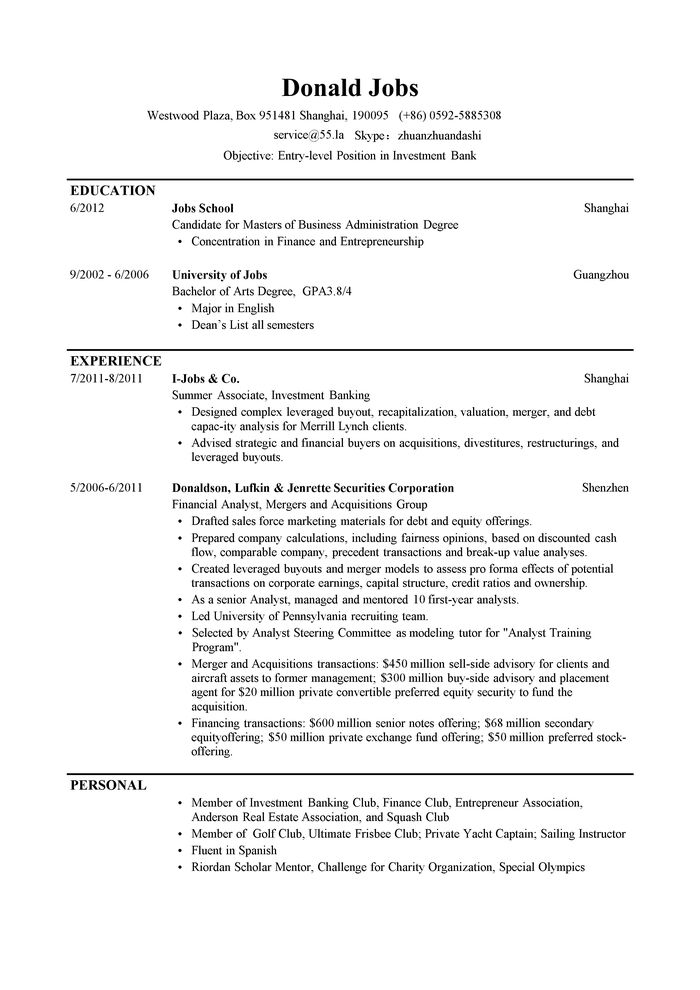

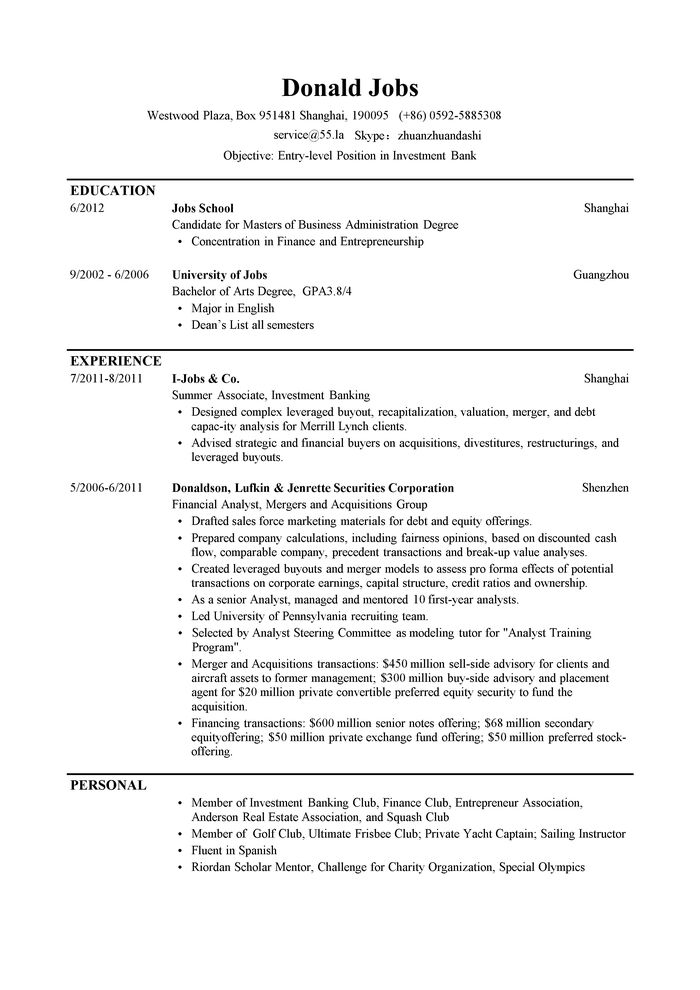

Donald Jobs

|

Westwood Plaza, Box 951481 Shanghai, 190095

|

(+86) 0592-5885308

|

service@55.la

|

Skype:zhuanzhuandashi

|

Objective: Entry-level Position in Investment Bank

|

|

|

EDUCATION

|

6/2012

|

Jobs School

|

Shanghai

|

|

|

Candidate for Masters of Business Administration Degree

|

|

|

•

|

Concentration in Finance and Entrepreneurship

|

|

|

9/2002 - 6/2006

|

University of Jobs

|

Guangzhou

|

|

|

Bachelor of Arts Degree, GPA3.8/4

|

|

|

•

|

Major in English

|

|

|

•

|

Dean’s List all semesters

|

|

|

EXPERIENCE

|

7/2011-8/2011

|

I-Jobs & Co.

|

Shanghai

|

|

|

Summer Associate, Investment Banking

|

|

|

•

|

Designed complex leveraged buyout, recapitalization, valuation, merger, and debt capac-ity analysis for Merrill Lynch clients.

|

|

|

•

|

Advised strategic and financial buyers on acquisitions, divestitures, restructurings, and leveraged buyouts.

|

|

|

5/2006-6/2011

|

Donaldson, Lufkin & Jenrette Securities Corporation

|

Shenzhen

|

|

|

Financial Analyst, Mergers and Acquisitions Group

|

|

|

•

|

Drafted sales force marketing materials for debt and equity offerings.

|

|

|

•

|

Prepared company calculations, including fairness opinions, based on discounted cash flow, comparable company, precedent transactions and break-up value analyses.

|

|

|

•

|

Created leveraged buyouts and merger models to assess pro forma effects of potential transactions on corporate earnings, capital structure, credit ratios and ownership.

|

|

|

•

|

As a senior Analyst, managed and mentored 10 first-year analysts.

|

|

|

•

|

Led University of Pennsylvania recruiting team.

|

|

|

•

|

Selected by Analyst Steering Committee as modeling tutor for "Analyst Training Program".

|

|

|

•

|

Merger and Acquisitions transactions: $450 million sell-side advisory for clients and aircraft assets to former management; $300 million buy-side advisory and placement agent for $20 million private convertible preferred equity security to fund the acquisition.

|

|

|

•

|

Financing transactions: $600 million senior notes offering; $68 million secondary equityoffering; $50 million private exchange fund offering; $50 million preferred stock-offering.

|

|

|

PERSONAL

|

|

|

•

|

Member of Investment Banking Club, Finance Club, Entrepreneur Association, Anderson Real Estate Association, and Squash Club

|

|

|

•

|

Member of Golf Club, Ultimate Frisbee Club; Private Yacht Captain; Sailing Instructor

|

|

|

•

|

Fluent in Spanish

|

|

|

•

|

Riordan Scholar Mentor, Challenge for Charity Organization, Special Olympics

|

|

|

邮箱

电话